Pradhan Mantri Awas Yojana 2020: -If you are looking to purchase a house, then Pradhan Mantri Awas Yojana (PMAY) will make your work simpler.

Toward the start of this plan, Pradhan Mantri Awas Yojana Gramin was only for poor people. Yet, presently by evolving this, individuals of the urban poor and working-class will likewise have the option to purchase their homes under the Pradhan Mantri Awas Yojana Housing for all urban.

According to the new rules 2020, the amount of subsidized home loan in Pradhan Mantri Awas Yojana (PMAY) was from 3 to 6 lakh rupees however now its degree has been expanded to 18 lakh rupees.

|

| Pradhan Mantri Awas Yojana |

Pradhan Mantri Awas Yojana Eligibility:

1. Who can avail Pradhan Mantri Awas Yojana?

Any individual can avail of the benefit of Pradhan Mantri Awas Yojana from 21 to 50 years. Be that as it may, If he is over 50 years old, his lawful beneficiary will be remembered for the home advance.

2. What should be the annual income for availing Pradhan Mantri Awas Yojana?

a) The annual income for EWS (Lower economic class) should be 3 lakhs.

b) The annual income for LIG (Low income group) should be between 3 to 6 lakhs.

c) The annual income for MIG (Medium Income Group) should be between 12 to 18 lakhs.

Proof of income has to be given:

A) Those who get pay should show a salary certificate, Form 16, or Income Tax Return (ITR).

B) Those who do their work and their pay is 2.5 lakh or less, at that point, the affidavit will be introduced as income certificate for the income.

C) If your yearly salary is more than 2.50, then sufficient proof of income will have to be presented for the income.

Pradhan Mantri Awas Yojana Terms and Conditions:

How much subsidy is available in Pradhan Mantri Awas YojanaIn Hindi?

- 6.5% sponsorship is accessible for credits up to 6 lakhs.

- The individuals who have a yearly pay of Rs. 12 lakhs get 4% intrigue sponsorship on advances up to Rs. 9 lakhs.

- The individuals who have a yearly pay of Rs 18 lakhs get an advance of up to 12 lakhs and can benefit from a 3% intrigue appropriation on that credit.

Pradhan Mantri Awas Yojana is nothing but the amount of subsidy on interest on annual income or income.

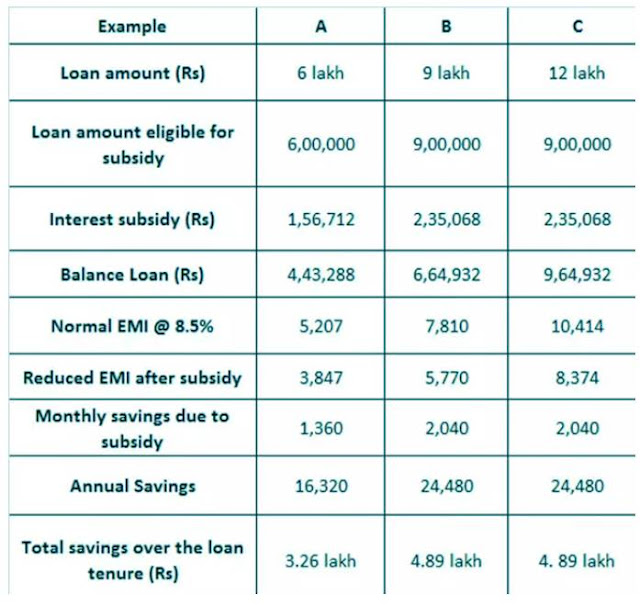

Here we have done this calculation according to the interest on the home loan.

|

| Pradhan Mantri Awas Yojana |

Loan amount reduces under Pradhan Mantri Awas Yojana Calculator:

|

| Pradhan Mantri Awas Yojana |

Let's understand the above image as follows -

Assume the annual income of a person is 6 lakh rupees.

Presently the man took a loan of 6 lakhs.

The man will get a subsidy on the loan sum at 6.5 percent.

Assume the interest rate on a home loan is 9 percent.

As indicated by this, the EMI payment will be Rs 5398.

If this loan is for 20 years, the total interest will be Rs 6.95 lakh.

But when it gets a subsidy at 6.5, then your NVP will be Rs 2,67,000.

This is the interest subsidy available in the Pradhan Mantri Awas Yojana. As needs are, your credit which was 6 lakhs turns out to be just 3.33 lakhs.

How to apply for Pradhan Mantri Awas Yojana Online Application:

Recipients can apply for PMAY through the accompanying:

A. Online

On the web Pradhan Mantri Awas yojana official website pmaymis.gov.in

People can visit the official site of the plan to apply on the web. They have to have a legitimate Aadhaar Card to apply.

B.Offline

Recipients can apply for the plan disconnected by topping off a structure accessible through Common Service Center (CSC). The cost of these structures is Rs. 25 + GST.

How to check your name in PMAY 2020 Beneficiary List?

Those qualified for the plan can check their name in the Pradhan Mantri Awas Yojana list by following these couple of steps:

Stage 1: Visit the official site.

Stage 2: Click "Search Beneficiary".

Stage 3: Enter the Aadhaar number.

Stage 4: Click "Show".

Pradhan Mantri Awas Yojana Terms and Conditions :

Just the individuals who have a place with monetarily flimsier segments of society or lower pay gatherings can apply for this plan.

In the event that any time of time the candidate has distorted certainties, the advance might be dropped and the appropriate lawful move will be made.

In the event that there is any deception in salary evidence, the advance allowed will be dropped and the appropriate legitimate move will be made.

RELEVANT PAGES FOR YOU

- PMAY Mumbai

- PMAY Chandigarh

- PMAY Uttar Pradesh

- PMAY Delhi

- PMAY Ahmedabad

- PMAY Subsidy Calculator

- PMAY Surat

- PMAY Haryana

- PMAY ICICI Bank

- PMAY Lucknow

- PMAY Kolkata

- PMAY Axis Bank

Pradhan Mantri Awas Yojana Documents:

The candidate needs to give their Aadhaar subtleties and one can't have any significant bearing for this plan without one

For Identity and private evidence, the reports that can be outfitted incorporate PAN card, Voter ID, Driving License

In the event that the candidate has a place with a minority network, the confirmation of similar needs to give.

There is have to give verification of Nationality. This should be possible utilizing the visa

Financially Weaker Section authentication or Low Income Group endorsement ought to be given

Compensation slips.

IT return explanations.

Property valuation authentication

Bank subtleties and record explanations.

Verification that the candidate doesn't claim a 'pucca' house.

Verification that the candidate is developing a home under the plan.

Pradhan Mantri Awas Yojana Videos

Pradhan Mantri Awas Yojana(PMAY) FAQs :

Who is qualified for Pradhan Manti Awas Yojana?

The accompanying people and families are qualified for this plan:

Financially Weaker Section (EWS) – Families with a yearly salary up to Rs. 3 Lakh.

Low Income Group (LIG) – Families with a yearly salary between Rs. 3 Lakh and Rs. 6 Lakh.

Center Income Group I (MIG I) – Families inside a yearly salary between Rs. 6 Lakh and Rs. 12 Lakh.

Middle Income Group-II (MIG II) – Families with a yearly salary between Rs. 6 Lakh and Rs. 12 Lakh.

Ladies having a place with EWS and LIG classes.

Planned Caste (SC), Scheduled Tribe (ST), and Other Backward Class (OBC).

Notwithstanding the abovementioned, recipients can profit the advantages of this plan by meeting the accompanying scarcely any qualification criteria –

He/she should not claim a house to satisfy the Pradhan Mantri Awas Yojana qualification.

The individual should likewise not profit the advantages of some other lodging plan by the State or Central Government.

Is Pradhan Mantri Yojana accessible to existing home credit borrowers?

Existing home credit borrowers are qualified for this plan gave they satisfy all the pertinent qualification criteria.

Pradhan Mantri Yojana has assumed a critical job in giving moderate lodging. The job of this plan isn't restricted to making lodging available and moderate to all regardless of their money related steadiness, yet it has additionally made abundant openings for work in the land division. This plan, alongside the incorporation of RERA, prompted the production of about 6.07 Crore employments the country over.